Dear Young Wealth Seeker,

Kim is 24 years old. She has been out of college and working for two years.

Kim has been working hard and making money. She is making money from both a full time job and a side hustle. (Go Kim!) Since she lives at home with her mother, she pays a small amount for rent, but has the majority of her net income left for her to do as she wishes. She did have a small student loan. But, she was able to pay that off in approximately one year. Since she lives in a small city with pretty good public transportation, she does not need a car to get to work. (Although she would like to look into buying a car next year.) While Kim spends a lot of time working, she does budget for going out for fun once or twice a month.

First Investments

Kim has been depositing money automatically into both of her tax-sheltered accounts. This includes her 401K with her job, and her Roth IRA. She hopes to max-out her Roth contributions this year.

She also has a taxable investment account with Robinhood, in which she buys stocks occasionally. Kim is satisfied with stocks investments in all of these accounts so far.

Now, Kim is wondering if there is something else that she can invest in, to grow her money. She wants to diversify her investments. But, she has no idea of how she can do that.

I know that you are also interested in growing your money.

Did you know that owning real estate is an excellent way to build wealth? So, after stocks, I suggests that Kim consider real estate.

You may be wondering…

How does real estate build wealth?

Well, when you buy real estate as an asset, it is income producing property.

Real estate that is an asset for you is real estate that you own, at least a portion of, that someone else pays you to use. That makes it a business and therefore, tax advantaged. Real estate also tends to appreciate, which means it goes up in value.

So, residential rental properties are assets that make you money. Farm land that you lease to farmers would also be an asset.

If you live in a home that is fully paid for by you, rather than having some tenants, I am with those that do not consider this an asset, because rather than making money for you, it costs you money (via taxes, maintenance, etc.) Your home may appreciate. But, you cannot truly get that appreciation out of it unless you sell the asset. Similarly, you can not get income cash flow out of it, unless you rent out at least part of it.

I love real estate, and recommend it as one of the three main parts of building your wealth.

In fact, one of the main reasons that I like rental real estate is that it tends to do well when the stock market has a period of not doing well. It is also considered a hedge against inflation, because as a landlord’s cost of living goes up, the rents for tenants go up also.

However, since you are young, you may not have the money to start buying rental properties yet.

Luckily, there are other ways to invest in real estate.

One of those other ways to invest in real estate is via REITs.

What is a REIT?

REIT is an acronym for Real Estate Investment Trust. REITs are companies that own, operate, or finance income-producing properties. These properties include apartment complexes, cell towers, data centers, hotels and resorts, medical facilities, offices, retail properties, and warehouses. Most REITs specialize in a particular type of property. Some have a combination of types of properties.

How Do REITs Make Money?

REITs make money in two basic ways: They can own the properties and earn via rental income and property management fees. Or, they can earn money via real estate debt, i.e. mortgages.

How Do I Earn Money WIth REITs?

Similar to stocks, REITs pay dividends. REITs are required by the government (the IRS) to pay out 90% of their taxable income to shareholders. So, those dividends tend to be higher than the dividends you would receive from the average stock on the S&P 500 index.

After Stocks, Should I Invest in REITs?

After stocks, I like to start investing in REITs. Here are my 5 reasons that I like investing in REITs:

REITs tend to have higher dividend yields than the average stock on the S&P 500.

As with brick and mortar properties, it has been said that REITs are a way to recession proof a portfolio as well as a way to hedge against inflation.This means that the value of real estate goes up in value when other prices are also going up during inflation.

REITs provide truly passive income, in the form of the dividends.

According to The Motley Fool, a well known financial and investing advice company, REITs are less volatile than stocks.

Since I like both real estate investing and stock investing, I view REITs are a marriage of the two. However, they are an easier way to get into investing in real estate than buying a piece of real estate.

But, one thing about REITs is that they are taxed less favorably than stock.

They are taxed the same as earned income, while stock dividends are taxed at a lower rate.

Therefore, I recommend that, when possible, REITs be purchased in tax advantaged accounts, such as IRAs and 401Ks.

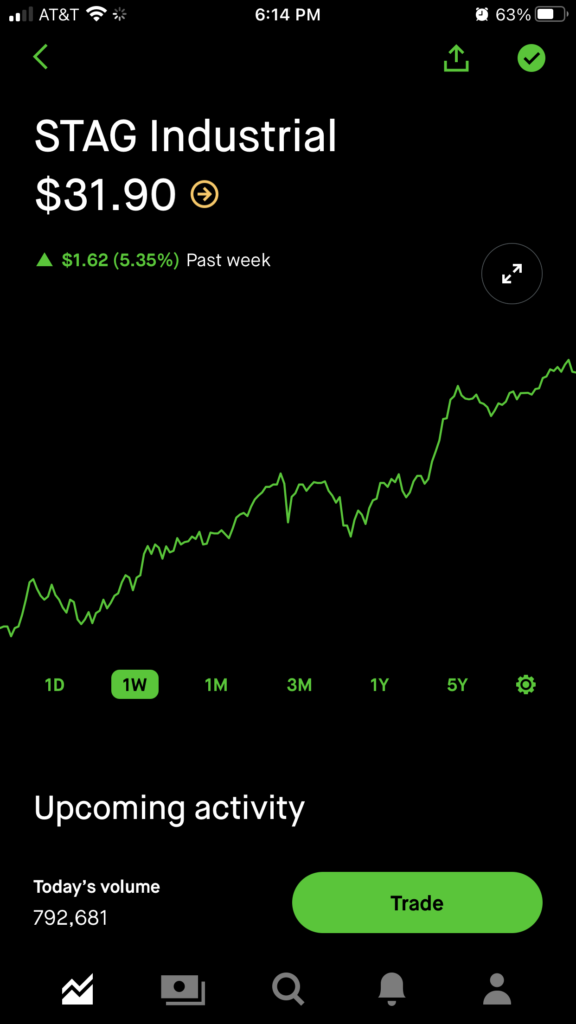

So, yes, I suggest that you consider purchasing REITs, as a first step in investing in real estate. One of my first REIT investments was Stag Industrial Inc. (stock symbol: STAG), shown in the photo above.

Investing in REITs is the easiest way to invest in real estate. You can invest in it by going through a brokerage firm, such as Fidelity Investments, or convenient investment apps such as Robinhood.

I hope this helps.

Until Next Time,

Rich Mom

P.S. Have you started investing in real estate yet? Let me know in the comments.

P.P.S. If you received any value from this letter. I’d love for you to:

- Subscribe to this blog.

- Share the post with at least one friend.

- Share this post on your social media, life Facebook, Instagram, Pinterest, or Twitter.

- Please share in the comments: What is your favorite activity to do with friends?

Doing these things really helps my blog, and helps me know that I am helping people.

Thank You!

If you are interested in investigating and/or buying REITs, you can do it through the Robinhood app. If you use my link to sign up for an account, you can receive a free stock, while the offer from Robinhood lasts. Robinhood

Do you want to read more of a mom’s letters written to inspire financial independence by age 30? Check out:

Spilling the Tea on Five Things I Don’t Spend Money On

Top 13 Things To Remember About Budgeting

There’s also:

If you would like, you can use the following link to check out this Motley Fool article about REITs: https://www.fool.com/investing/2022/01/28/worried-about-market-volatility-add-reits-to-your/

I am not an investment advisor. Always do your own due diligence and research before investing. Check with your own investment advisor.

Also remember that past performance is not a guarantee of future performance.