Hello Family! A recent subject that someone wanted to discuss with me – interest vs. dividends…What’s the difference? That’s such a great question! So, that is today’s topic…interest vs. dividends.

Before I start, I want to make sure that you know why I write to you. I write to you because I have made a promise to share the best financial education made just for you. As a person who has both seen people work for many years, always struggling and as a mother who wants better for her child, I want to share information that can help her generation. I assure you that you can become healthy, happy, and financially secure. It is all in the mindset. Your mindset needs to be one that recognizes that small steps repeated and added together can take you great distances. Keep taking those steps toward your goals.

Now, Let’s Get Started Discussing Interest vs. Dividends.

Something Interest and dividends both have in common is that they are forms of income that you can earn.

Interest vs. Dividends – What is interest?

Interest is money that is earned from money that is lent. It is expressed as a percentage. You earn interest when you lend money. You pay interest when you borrow money.

When do you lend money and earn Interest?

When you deposit money into a savings account, you are lending your money to the bank. In exchange for lending the money to the bank, the bank pays you interest.

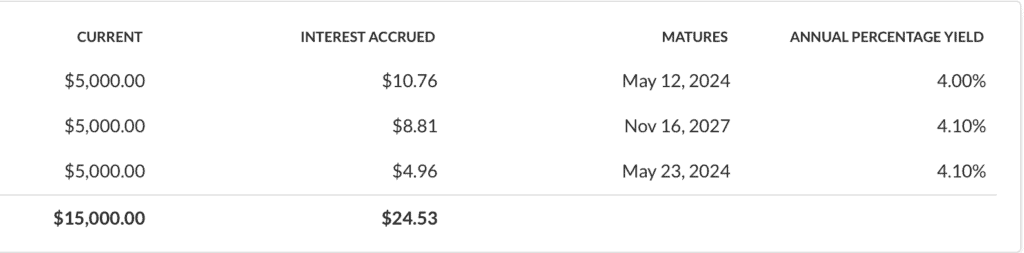

When you put your money into a certificate of deposit (AKA a CD), you are lending your money to the bank for a set period of time. Your money is locked up for that time period, and you can’t get it back unless you pay a penalty. So, in exchange for your money being lent to the bank for a set period of time, the bank pays you interest at a higher rate than if you have that same amount of money in a savings account. In general, the longer your money is in a CD, the higher the interest you will be paid.

Why is the bank willing to pay you money to hold your money?

It’s because the bank uses your money to make money, Your money is not just sitting in the bank. The bank loans your money out and earns interest. Note: The interest that the bank pays you is far less than what they pay you.

On the other hand, when do you pay interest?

You pay interest when you take out a loan from a bank. If you take out a mortgage, you basically pay back the mortgage in two parts: principal and interest. The principal is the amount that you borrowed. Interest is the money that you pay the bank for the privilege of borrowing the money. Other common transactions that require you to pay interest include:car loans, student loans, and credit card debt.

Interest vs. Dividends –What is a dividend?

A share of stock represents ownership in a publicly held company. Some stocks pay dividends. Some stocks do not pay dividends. A dividend is money paid to owners of dividend paying stock. The dividends are basically part of the profit made by the Dividends are expressed in terms of annual yields.

Interest vs. Dividends -Major Differences

- Interest from a CD is guaranteed by the bank (and indirectly by the FDIC.) Dividends are not guaranteed. A company can reduce or stop paying a dividend.

- If a CD is bought through a bank, the interest is usually paid out when the CD matures. Dividends are usually paid quarterly, but some stocks payout semi-annually or annually.

- The principal from money invested in a CD for interest stays the same. The value of an individual stock (basically, its principal) can increase.

- Interest is typically taxed the same way as earned income. Qualified dividends are taxed at a lower rate than earned income.

Key Takeaways

- Interest is what is paid when money is loaned.

- You can earn interest, or you can pay interest.

- Dividends are payments stockholders receive from a company’s earnings.

- Both interest and dividend are forms of income.

- Both interest and dividend income are considered passive income.

- You don’t need a lot to start these streams of income

- Interest and dividends are taxed differently.

- Compounding speeds up the growth of both interest and dividends.

Should you get interest or should you invest in dividends?

You want to have both. Dividends usually provide a better cash flow. On the other hand, interest from bank instruments is safer (because it is insured by the FDIC.). So, for the best results, combine these methods, providing yourself two different streams of income and avoiding having all of your eggs in one basket.

I hope that this information was helpful. If you know someone else who would find this information useful, please share a link to this post.

Do you want to read more of a mom’s letters written to inspire financial independence by age 30? Check out:

Start Creating Passive Income Today (Everybody should be getting at least some passive income!)

Nine of My Favorite Dividend Stocks

There’s also:

Until next time, stay safe and have fun building your wealth.

Hugs,

Rich Mom

Wondering About Rich Mom?

If you stumbled upon this post and you are wondering who Rich Mom is: I am a tea lover and a mother to a young adult. My majors and degrees are in business, economics, and education, and I am passionate about financial literacy and personal finance. I am worried about the future of young adults who are often being burdened by massive student loan debt, but at the same time have never been taught about financial literacy.

So many people work forever.

So many people work, forever living just paycheck to paycheck, never understanding the pattern that would make their lives easier. My goal with my blog is to inspire those ages 30 and under to become more financially literate, become financially independent, and be able to live a healthy (mentally and physically), happy, generous life, in which you can help others do the same. But remember, my blog is intended to inspire, but not as investment advice.

I am not an investment advisor. Always do your own due diligence and research before investing. Check with your own investment advisor.

Also, remember that past performance is not a guarantee of future performance.

The information shared here is not intended as financial advice, just entertainment and encouragement.

If you like the financial literacy information that I have provided, I ask you to do three things:

1) If you know someone who might find this information useful, please share it on Facebook, Pinterest, and/or Twitter.

2) If you like this post, please hit the like button.

3) Please hit the subscribe button and follow. It helps Google to know that it should keep sharing my posts.

Resource(s):

If you are trying to maximize your interest earnings, you may want to maximize the interest that you earn. I use and recommend CIT Bank for their higher interest accounts.