Dear Young Income Earner, I am an advocate for passive income. But, when I mentioned this to someone recently, the person asked, “What passive income can I get to pay my bills? My response was that one usually has to build up to that much passive income. The person responded to me by saying that they didn’t have time to wait to build it. She said that passive income was therefore a no-go for her. I am here to tell you that a small passive income is better than no passive income.

Why Is a Small Passive Income Better than No Passive Income?

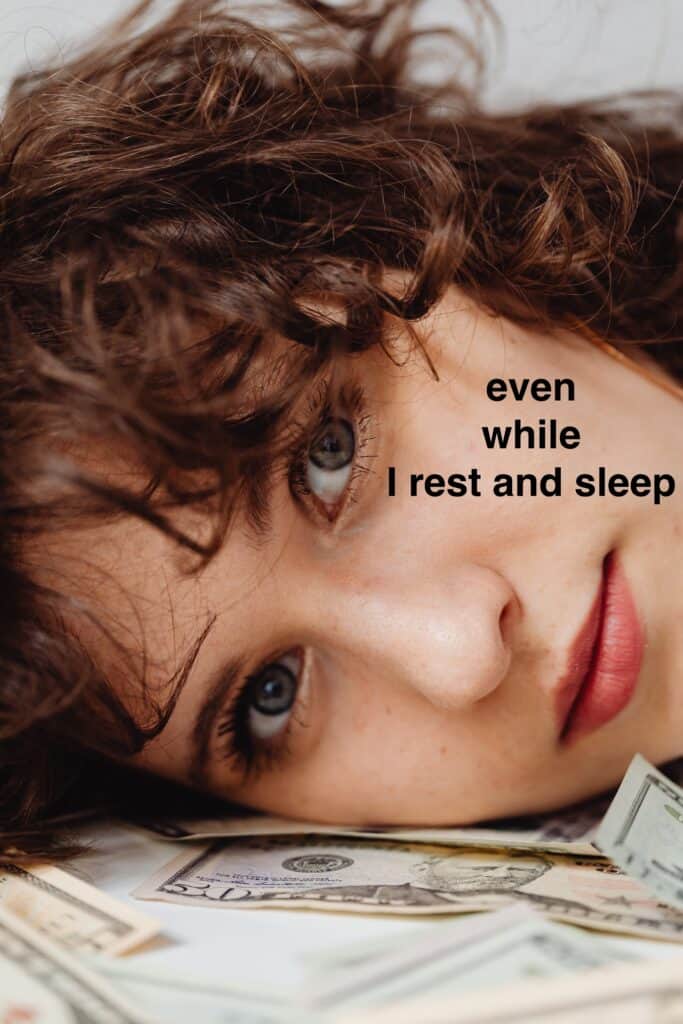

Most of us trade our hours for money. Need more money? Some people would only give you the advice to just keep working more hours and, if necessary, to keep adding on part-time jobs. But, you need more than hourly wages, because there are only so many hours that you can work. Instead, you need to have more streams of income, and those streams of income need to be able to operate when you are busy in your active employment, or even sleeping. In other words you need streams of income that are passive.

Even a small passive income is better than no passive income. Why? First, even small amounts of extra money can pay for, or at least help pay for something. For instance, a while ago, when Starbucks first became popular, I knew someone who treated herself to a Starbucks coffee once a month using $5 a month that she earned from interest and dividends. That was special to her. In fact, she said that she used it as a way to motivate herself to keep saving and investing. As long as she stuck to her savings and investing plan for the month, she would treat herself at Starbucks.

In a more personal example, at one point, I designated interest that I earned as money to pay one of my utility bills

.

The second, and more important reason that small passive income is better than no passive income is that it has the potential to grow over time, even if you do little active work to make it grow.

This second reason relates to a third reason that a small passive income is better than no passive income, which is: In order to start acquiring wealth, you need to find ways to speed the process of increasing income. Passive income can continue to grow whether you get a raise from your active job, or even change jobs. That passive income of yours can just keep growing.

Now obviously, to make passive income grow a lot, you need to put in a lot of work up front to make it able to do so. Anyone telling you otherwise is lying to you. But, what is the alternative? You can do nothing and never even have the chance to build passive income. Or, you can start taking small steps towards trying to create more for yourself in the future.

My suggestion for you? I suggest that you get started on planning your pursuit of passive income today.

What Are the Best Options for Earning Passive Income? (Since A Small Passive Income is Better Than No Passive Income)

1. Interest

Interest is money that you earn by keeping your You can maximize your interest from by using a high yield savings account. These are online banks. Because these banks don’t have the overhead of brick and mortar locations, they can afford to pay you a higher interest rate. In fact, they can pay up to 20 times the national average of traditional savings accounts. What does this look like in action? Well, if you had $10,000 in a traditional bank, it may pay a .01% interest rate. That would earn you $10 in interest in a year. However, if you had your money in CIT Bank, which is one of my favorite banks, your money would (at the time of my writing this) be earning 4.05% APY. This means that your $10,000 would earn you $405.

2. Stock Dividends

With stock dividends, you use your money to purchase partial ownership in companies. If you purchase stock from companies that pay dividends, you will receive these dividends on a regular basis.

How do you know which stocks to pick? That is a tough question. There is no guarantee when you invest in a stock. So, I like to invest in the entire U.S. stock market by purchasing shares in an S&P 500 index. By investing in the S&P 500, I benefit based on how the entire market is doing. I own a stock called VOO. Not only does it pay dividends, but it usually grows in value, too.

The overall stock market has historically, between 1900 and 2022, grown by over 9% a year. But, that does not mean that it grows that much each year. Sometimes it has been up. Sometimes it has been down. For this reason, investing in the stock market is a long term endeavor.

Also note that you don’t need a lot of money to at least get started. You can open an investment account using an investment app such as Robinhood for as little as $5.

NOTE: While I personally like the stock market, always check with your own personal finance advisors before investing. Stock investing is one of my favorite way to grow passive income.

3. REITs

Do you wish that you could invest in real estate, but don’t have enough money to buy a property yet? Consider investing in REITS for passive income. REIT is an abbreviation for Real Estate Investment Trust.

REITs are purchased through investment houses such as Robinhood or Fidelity, just like stocks (Many people even call them stock.) They tend to have higher dividend yields than other types of investments.

Just to get you started, check out one of the more popular REITs called Realty Income, ticker symbol “O.” Realty Income pays dividends each month and, as of the day that I am writing this, they have a dividend yield of 4.51%.

There are REITs that have much higher dividend rates than realty Income. But, I like Realty Income because they are part of a group of stocks called Dividend Aristocrats.

Dividend Aristocrats are companies that are part of the S&P 500 that not only have paid dividends consistently without missing any payments, but also have increased their dividends consistently for at least 25 years. So, I feel a bit more confident in this REIT than some others.

But, again, don’t just blindly follow someone on the internet. always check with your own personal finance advisors before investing.

4. Affiliate Marketing

Affiliate marketing is the process in which you make money by

recommending products and services to others and receiving a commission when those people purchase the product or service. Typically, when you sign up to be an affiliate for a product or company, you receive your own personal affiliate link to share with others.

Where can you share your affiliate links? You can share the link in places such as blogs, newsletters, YouTube channels, Facebook, Instagram, emails, LinkedIn, etc.

5. Drop Shipping

Drop Shipping is where you find a product that you want to sell. But, instead of creating, buying or storing the product, you find a company that supplies the product. You take a picture of the product and put it on your website at a price that is higher than the price that you would pay the producer.

When the customer buys the product, you take the extra money to keep, then use the rest to pay off your supplier.

I have not done drop shipping. So, I cannot tell you about any personal experience. But I know that you can drop shipping using Shopify. If you are interested, I am sure that you can learn more about drop shipping by doing research online.

6. Print on Demand

Print on demand is a way to sell custom printed items that you sell on line. It is an automated process in which you design items and put them into your online store. When people order the item and pay for them, the print on demand company prints the item, packages it, and sends it to the customer. So, you can start this business with no money from you because the customer pays the print-on-demand company and then your profit remains in your account with that company until you withdraw it. I actually have made a small passive income in the past using Spring (formerly called Teespring.)

7. Digital Products

Anything that you can make on a computer can possibly be sold as a digital product over the internet. The great thing about digital products is that once you create the product, you can sell that product over and over again, infinitely. Examples of digital products that people are selling online include: courses, apps, and Excel templates. I actually make a small passive income selling digital educational products on a website called TPT (formerly called Teachers Pay Teachers.) Everytime I sell a product, I receive an email notification that reads, “Congrats! You sold a product on TPT! (I love receiving these!)

8. Rental Income

Rental income is money made by renting out something that you own. Some people rent out their cars. Turo is a website for that. Some people rent out tools, through websites like Sparetoolz.

But, the most popular rental income comes from rental real estate. Obviously, you have to have a considerable amount of money to buy a rental property. However, you might be surprised at how soon you might be able to purchase a rental property.

If you purchase a multi-family property, the mortgage company will sometimes include a portion of the money that you make via tenants as part of the required income to qualify for the mortgage.

A rental property can be used for either long term or short term rentals (such as AirBNB or VRBO.)

Another way that you can make rental income is by renting out a room in your house or apartment.

I have owned long term rental properties, and I have lived in a multi-use property with a commercial tenant on the lower level. It is a great way to supplement your active income from a job.

So, there you have it.

A small passive income is definitely better than no passive income. If you start now you can build up your passive income over the years. I’ve shared 8 ideas. But, there are even more ways.

Key Takeaways About Why A Small Passive Income is Better Than No Passive Income

- Small passive income is definitely better than no passive income.

- It can continue to grow without little continued work on it. But grows much better when you continue to build it.

- Passive income allows you to earn more income that can continue to grow even when you change jobs.

- Some of the Methods to Create Passive Income:

- Interest

- Stock Dividends

- REITS

- Affiliate Marketing

- Drop Shipping

- Print on Demand

- Digital Products

- Rental Income

- There are other ways to build passive income, too.

- Start now in order to build up something bigger in the future.

- Be careful of scammers who promise easy passive income with no work or money. Any passive stream requires either your money or your time or a combination of both to set up.

Have you thought about creating passive income? Do you have any sources of passive income yet? Let me know in the comments.

Do you want to learn more about passive income? Check out:

Earn As Much Interest As Possible

Start Creating Passive Income Today

Thank you for reading this. I like to spread financial literacy. By reading this, you are helping me with my goal.

And don’t forget to subscribe to the Rich Mom Poor Kid Blog, in order to continue to build your financial literacy!

Hugs and Best Wishes On Starting Your Passive Income,

Rich Mom

Do you have money for investing, but not sure where to start, try Acorns

Not only does the Acorns App help you simplify and automate your investing, it also allows you to boost your investments using your spare change. I love it!

Looking for other financial resources? Check out the Rich Mom Poor Kid Resources Page.

Who is Rich Mom?

If you’re wondering who Rich Mom is, check out my “About Rich Mom” page.

Also, please note: I am not an investment advisor. Always do your own due diligence and research before investing. Check with your own investment advisor.

The information shared here is not intended as financial advice, just encouragement.

Stay Connected:

Facebook: Rich Mom Poor Kid on Facebook