Dear “Wondering About Spending Habits”, Have you ever wondered, “Does being cheap make you rich?” I have heard this question in one form or another several times. Before I get started sharing my opinion on this topic, I want to say “Thank you for reading this. By doing so, you are helping me with my goal of sharing financial literacy. So, I greatly appreciate you.”

Now, on to today’s topic.

Does Being Cheap Make You Rich?

First, I am not sure what people mean when they use the word “cheap.” Do they mean cheap, or do they mean frugal? Those two words have different meanings.

Frugal or Cheap?

A frugal person takes quality into account and looks for ways to acquire good quality at a low price.

However, being cheap means that you buy whatever costs the least. You don’t care about quality. You only care about price.

If the people asking about being cheap actually mean frugal, then the answer is that frugality is a way of living that can contribute to becoming rich.

On the other hand, being cheap can have unexpected consequences that sometimes lead to spending more money in the long run.

For instance, when I was a teen, I knew a woman who would drive from one side of her large city to the other side if she heard that there was a sale on produce. However, I don’t think that she ever took the cost of gas for her car nor the cost of her time into account. I used to ponder her decision to take that trip for some lettuce and tomatoes. But, at the time, I didn’t think it wise to question my “elder.”

Another example of how being cheap costs more money is when you buy a cheap item that you will soon need to replace because the item lacks durability and falls apart.

My last example of how being cheap can cost you more money rather than less is when it comes to your health. If you eat cheap, poor quality foods, that can not only lead to poor health, but also to an increase in medical bills which leads to a decrease in your bank account.

So, being cheap does not make you rich. But, being frugal is one tool that you can use on your way to building your riches.

How Does Frugality Contribute to Becoming Rich? (Since Being Cheap Does Not)

In order to build wealth, you have to increase your assets. Assets are things that earn you money on a regular basis. In order to buy and increase your assets, you need money. So, you need to save money to buy assets.

Where will you get that money? Well, the money that you save is based on a simple subtraction math problem: The amount you earn minus the amount that you spend equals the amount left over to save (and eventually use to purchase assets).

Can Frugality Make You Rich?

This is the big question. Can frugality really make you rich? I would say that frugality alone can not make you rich. Frugality can contribute to you becoming rich, but there is a ceiling on how much frugality can contribute because just like in a subtraction problem, the leftover part can never be larger than the starting amount. So, if you need more money to save and invest, you have to make the starting amount larger. In other words, you need to increase the amount that you earn.

However, no matter how much you earn, frugality will help you save the maximum amount.

So, I encourage you to consider using frugality as one of your tools to build wealth. If you do it while you are young, and use your savings to pay off debt and invest, you will benefit and be happy about it when you are older.

Do I Use Frugality?

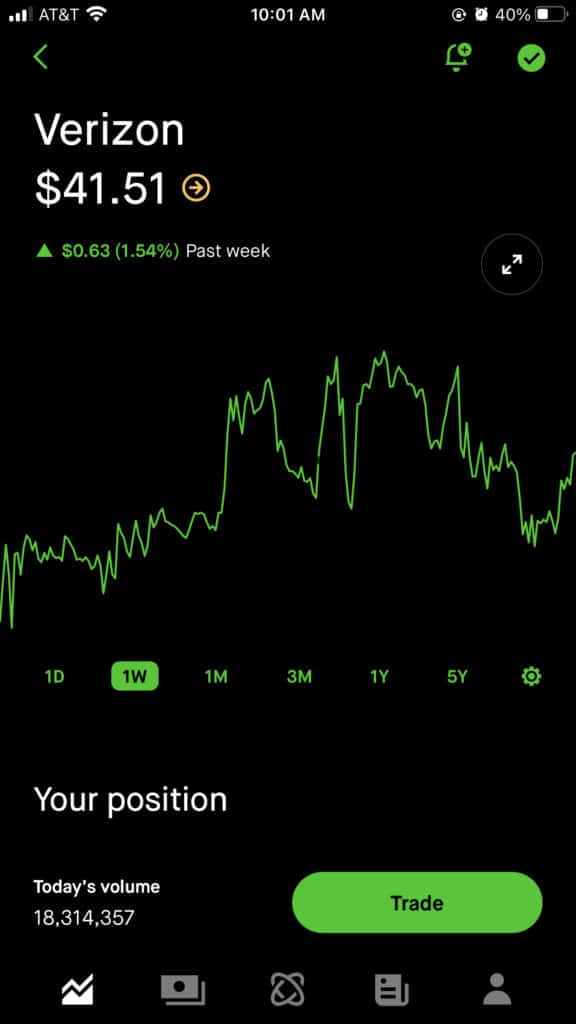

Yes! I do use frugality. Then when I have saved money and I am ready, I invest the money in dividend paying stocks through Robinhood. Those stocks are one of my assets that pay me money. By investing more and more bits of money that I have saved through being frugal I am able to buy more and more stocks, which slowly grows my passive income.

Here’s hoping that you join me on this frugality journey!

Hugs,

Rich Mom

P.S. Keep in mind that you do not have to live a frugal life permanently. But, having at least some periods of frugality can be a big benefit.

Would you like to learn more about frugality and saving money? Check out:

Frugal With Food: 10 Tips To Be More Frugal With Food

Spilling the Tea on 5 Things That I Don’t Spend Money On

5 Suggestions For How To Live Below Your Means

If you have money ready for investing, but are not sure where to start, try Acorns

Not only does the Acorns App help you simplify and automate your investing, it also allows you to boost your investments using your spare change. Acorns rocks!

Looking for more financial resources? Check out the Rich Mom Poor Kid Resources Page.

Who is Rich Mom?

If you’re wondering who Rich Mom is, check out my “About Rich Mom” page.

Also, please note: I am not an investment advisor. Always do your own due diligence and research before investing. Check with your own investment advisor.

The information shared here is not intended as financial advice, just encouragement.

Stay Connected:

Facebook: Rich Mom Poor Kid on Facebook